Financial risk is the variability in financial investment returns that a capitalist agrees to endure in their financial planning. Put simply, it is the probability that something will cause a loss in a particular investment venture, whether this is a property investment or a business.

Your ability (and willingness) to take on financial risk in pursuit of investment returns is highly dependent on your risk profile. You risk profile in turn is highly dependent on what stage you are in your personal financial life cycle.

Short Summary

Before you begin educating yourself on your own risk tolerance, it is important to identify where you are in your financial life cycle life, which we have classified into four main stages:

- Foundation.

- Growth.

- Preservation.

- Distribution.

Explore Your Risk Profile

Once you have identified your stage in the financial life cycle, you can explore your risk profile. Everyone has a different risk profile. An individual’s risk profile is made up of three different factors:

Once you have identified your stage in the financial life cycle, you can explore your risk profile. Everyone has a different risk profile. An individual’s risk profile is made up of three different factors:

- Tolerance

- Capacity

- Appetite

For example, a 30-year-old single male with high income and reduced expenditures will likely have a higher risk tolerance than a 70-year-old widowed granny who is on a pension.

This example illustrates why it is so important to factor in the stage of your financial life cycle in any property investment strategy. In fact, many successful real estate investors employ the services of a real estate investment mentor to help them formulate a winning strategy based on their financial life cycle when building an investment portfolio.

What are the four stages of a financial life cycle?

Before we begin, it is important to note, whilst the stage of a person’s financial life cycle is highly correlated to a person’s age, it is not always the case. With this in mind, here are the four stages:

Before we begin, it is important to note, whilst the stage of a person’s financial life cycle is highly correlated to a person’s age, it is not always the case. With this in mind, here are the four stages:

Stage 1 – Foundation: The foundation stage is everything about establishing the foundation for the remainder of your financial life. This phase will undoubtedly occur for most in their twenties-to-thirties and may include points like buying your first home, locating your career, purchasing brand-new cars and trucks, having kids, and more. This stage is everything about structuring income, saving earnings, and investing those earnings.

Stage 2- Growth: The growth phase is generally the longest of the 4-stages, ranging from the late twenties to pre-retirement. In this phase, the goal is to have educate yourself on the relationship between risks and returns, intensifying your financial gains gradually to attain strong growth on your funding for investment purposes. Typically, this is the stage where people shift their emphasis in the direction of financial goals like investing seriously, paying off their home loan quicker, leaving financial obligations, planning for retired life and so forth.

Stage 3- Preservation: If you remain in the broad range preservation phase, you’re most likely beginning to pivot your investments into much safer, more predictable assets. This phase typically occurs for individuals between their 40’s-60’s and lay the foundations for retirement. In this phase, and investment portfolio of properties and blue-chip shares that produce income may be more attractive.

Stage 4– Distribution: The final phase of financial life for most individuals is distribution. This is separate from presents, contributions or kindness along your financial journey and a lot more focused on how you will disperse what you have developed along your journey. Generally, this stage takes place upon retired life, where you will undoubtedly decide precisely how and what to spend your funds on. This is a time where some people choose to chase their life-long dreams or complete their bucket list things. For others, it might be a time to plan their estate or will, and what will undoubtedly be dispersed after they’re gone. Whatever the instance, the choice is your own, and there are no ‘ideal or wrong’ means on how you choose to spend or spend your cash.

How does my financial life cycle influence my property investment strategy?

Which stage you are in your own financial life cycle has a large determining factor you your risk profile. As our introduction explains, your risk profile is made up of three parts:

Which stage you are in your own financial life cycle has a large determining factor you your risk profile. As our introduction explains, your risk profile is made up of three parts:

- risk tolerance

- capacity to take on risk

- risk appetite.

All three parts of your risk profile needs to be assessed so that your ideal property investment strategy is formulated so that you can withstand the risks associated with any investment without impacting your lifestyle. There is no point building a property investment portfolio in such a way that you are kept awake at night because you have formulated a strategy that is not compatible with your risk profile.

Understanding the relationship between risk and returns

Risk is a vast subject, covering so many areas, including environment, economy, business, health, Insurance, security, and the list goes on.

What is the definition of risk?

In basic terms, the risk is the chance of something happening, which is generally associated with something negative. The process aims to identify risks that entail the uncertainty of the effects and implications of a particular action you take.

In basic terms, the risk is the chance of something happening, which is generally associated with something negative. The process aims to identify risks that entail the uncertainty of the effects and implications of a particular action you take.

Risk and the management of risk is so important, that the internet is full of information on this topic. So much so, that there is even an International Standard written to cover risk management, ISO 31000.

What is the definition of risk?

Return is defined as the profit (or loss) from an investment over a period of time.

Return is defined as the profit (or loss) from an investment over a period of time.

In the world of investment portfolios, there is a high correlation between risk and returns. When it comes to property investment, real estate investment mentors often balance these two relationships by taking into consideration their mentee’s risk profile and their financial life cycle.

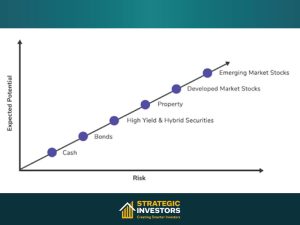

The higher the risk of an investment, the higher the returns one can expect over the long term. This concept can be illustrated by the chart below, where one compares the safest form of investments, like a fixed deposit in a bank vs high risk assets where the potential to earn inflation beating returns over the long term is high.

Personality Profile vs Risk Profile

There are many studies on understanding the relationships between risk-taking and personal type. Your outward appearance may look conservative though you may be an aggressive risk-taker. Observations on how to pigeonhole people concerning risk should not be done by assuming culture, sexuality, colour, financial position, or other superficial observations.

There are many studies on understanding the relationships between risk-taking and personal type. Your outward appearance may look conservative though you may be an aggressive risk-taker. Observations on how to pigeonhole people concerning risk should not be done by assuming culture, sexuality, colour, financial position, or other superficial observations.

Only by detailed analysis, one can truly understand someone’s risk profile.

As an example, a middle-aged divorced woman who is financially secure, who works in a conservative industry working for the same employer may be considered some who is unwilling to take a high-risk investment due to her previous history. But in her position, she is now more willing to take higher risks as the impact will not adversely impact her future lifestyle.

Balancing Risk

Risk is not a bad thing, and it comes with most aspects of life, and managing finances is not different.

Understanding the differences between the three types of risk, appetite, tolerance, and capacity, will provide valuable insight into yourself and empower you to make an informed decision.

It is crucial to consider the individual’s holistic well-being to investing, making it imperative to get the right combination. A too high-risk appetite with a low-risk tolerance and medium risk capacity will not be suitable for you as an investor, and it may cause high anxiety, health problems and mood swings.

Recognising your individual risk profile should be part of any financial planning and investment strategy sessions.

Working with professionals in this area, like a real estate investment mentor, will help you understand how it influences your decision making. Their help will be invaluable to getting the right mix.

Knowing your financial life cycle helps you choose the right personal financing structure

We have published a six-part series about why it is so important to choose the right legal entity when you start off building your property investment portfolio. A successful property investment strategy combines knowledge of a property investor’s financial life cycle with the knowledge of the most common legal entities available to real estate investors to optimise their winning strategy.

We have published a six-part series about why it is so important to choose the right legal entity when you start off building your property investment portfolio. A successful property investment strategy combines knowledge of a property investor’s financial life cycle with the knowledge of the most common legal entities available to real estate investors to optimise their winning strategy.

Leveraging knowledge of my financial life cycle to succeed in property investing?

A detailed, well thought out risk assessment is an essential part of any investment strategy process for your overall wellbeing. Understanding your risk profile will provide you, your financial advisor and, investment strategist or real estate investment mentor with crucial information to formulate a winning property investment strategy.

A detailed, well thought out risk assessment is an essential part of any investment strategy process for your overall wellbeing. Understanding your risk profile will provide you, your financial advisor and, investment strategist or real estate investment mentor with crucial information to formulate a winning property investment strategy.

There is no guarantee of the outcome or the elimination of risk and its consequences. But understanding what stage you are at in your financial life cycle, and using this to explore your personal risk profile gives you an understanding of your weaknesses and strengths, along with being able to create an appropriate strategy and mitigation plan to increase the probability of success.

At Strategic Investors, we have created a high level personal risk profile assessment questionnaire that incorporates your financial life cycle so that you can start the conversation with your team of professionals to tailor a property investment strategy that suits your risk profile.