Our Market View

Hello

Read our weekly emails that we send out to our community of followers.

Sept 2024 - Divorced

Hi

This message is for you if you’re divorced.

You see, I’m divorced and have been for a long time.

And yes, I know how emotionally draining it can be.

But it’s not just the emotional side which stings.

Because after the roller coaster of feelings slows down, another issue raises its ugly head.

Money.

Whether you like it or not, you’ve now got the money and assets that once supported and sustained one household, and now supporting two.

And it’s ugly, whichever way you look at it.

Suddenly, there might be a big chunk of money in your bank account, but there is no income.

Maybe a huge reduction in your super.

Or not having enough assets to retire from, flipping your plans of retiring early to retiring late. Especially once all the lawyers get their grubby hands on it.

All sorts of money problems.

And in my experience, in most relationships, there’s one money partner calling the shots and one who is passive about money.

If you weren’t the money partner, you could find yourself with big decisions to make, and without the skills to make them.

I’ve been through it before, and I’ve helped lots of people through it too.

And I’d like to offer you some time to give you some ideas and advice.

Even if your divorce was a long time ago, there are still some steps you can take to brighten your future.

Getting your life back on track after a divorce is tough, but with the right direction you could end up even better off than before.

To your future prosperity,

Duncan

P.S. These calls are going to be with me personally, not one of my strategists.

Helping people get back on their feet after a relationship breakdown is something very close to my heart.

18 Jun 2023 - Why the boom is the WRONG reason to invest

Hi,

I know it’s been a while since I sent you an email.

But I’ve decided this has to change, and I’m going to keep in touch with you more often now.

And the reason is that I’ve been talking to a lot of people about property investing.

And something’s occurred to me.

It’s that a lot of the people I talk to are investing for the wrong reasons.

And if you do, investing can be a bad idea.

Sure, there’s lots of people pushing the notion of investing because of booming house prices.

Except for me …

… the boom is the wrong reason to invest.

There’s one element which stands heads and shoulders above all that, and it’s being ignored.

In my experience, it’s the one factor which decides whether you’re going to be a hugely successful investor, or whether your investing journey will go nowhere like 90% of investors.

You see, the actual investment isn’t the most important bit.

Neither is the potential to cash in on some quick growth.

The proper reason to invest is because of how it helps you hit your life goals.

Sure, you might make some quicker gains right now.

But if it’s just a random investment and not part of a wider strategy then it probably won’t go very far.

Most people who are investing today will sell out once they think they could get more money somewhere else.

They’ll have pocketed some cash, but not really done much for their life in the long term.

Let me tell you a story about this.

I talked to a young girl recently about investing.

She was keen to get into the market.

But when we spoke, we both realised that she didn’t really know why.

Her parents invested so much in her family it was ‘the done thing’.

So we spent at least an hour and a half on the phone going through all this, and surprisingly …

… we barely spoke about investing at all for most of the call.

Instead we talked about her life. We talked about what the next few years looked like for her.

Kids, marriage, career, travel.

We knew where she was going.

But the property she was eying off wasn’t going to help her with any of these goals.

In fact, apart from that we barely even talked about houses at all.

And the reason is, there was no point talking about actual houses until she got crystal clear on what her goals were.

After this, we got to designing an investing strategy to help support her goals.

And it’s the same with all investors.

Some people have a huge mortgage to pay off and there’s various ways to help this.

Others need higher cashflow to supplement or replace their income.

Others might be on a good wage but want an early retirement strategy.

Planning to start a family or having a family already can mean totally different ways of investing.

Kids left home? Different strategies again.

Once you’re clear on your life goals, you design your investing strategy around them so they support and help you go forward.

This is why I say that for most people, investing because there’s a boom is pointless.

If it’s not supporting a clearly defined set of life goals then it’s just a random purchase.

And this is why investors fail in the long term.

Their investments aren’t strategic. They’re just random purchases which don’t fall into a strategy.

And because they don’t have a place in the investor’s strategy – or more often they don’t have an actual strategy – they just hang around achieving very little until the investor decides to cash in their chips and sell.

This is why I always work with my clients on their strategy first.

How old are you?

What do you see happening in your life in the next 2, 5, 10, and 20 years?

What would you really want if they could wave a magic wand and make your dreams come true?

And from there, we can put together a plan for what they should be investing in, and how each investment sets up the next investment.

And of course, how all these investments sit alongside their goals to help make them come true.

With all this in mind, I’m going to keep in touch with you every week from now on.

I’m going to make sure you’re getting a different perspective on property investing which nobody else is talking about.

And which is, in my mind – the most important yet overlooked part of successful investing.

Talk soon,

P.S. This has inspired me to completely rebrand my business as the Strategic Investor.

There’s a new website and more importantly, a new online masterclass coming which takes you through all this.

In the meantime though, if you want to talk about your goals and explore how property and investing in general can help you then hit reply with your phone number and I’ll give you a call.

11 Jun 2023 - Why King Charles doesn’t kill people these days

Hi,

Happy Birthday Charlie!

It’s the King’s Birthday today.

Yes, today’s the sleep-in formerly known as the Queen’s Birthday.

Do you know how Charlie can afford the upkeep of a string of castles around the UK, his string of royal cars, and all those funny robes?

Well, in the old days, the king would just announce a new tax to pay for his upkeep.

And if anyone refused to pay it …

… he’d get his ‘compliance officer’ to go around there and lop their head off.

Well, those days are long gone. And no matter how nostalgic you feel about them, they’re not coming back.

Fortunately for Charlie, he’s got another source of income.

Property!

The royal family owns The Crown Estate, one of the most valuable property portfolios in the world.

It contains everything from extravagant palaces and castles to humble bed and breakfasts.

And some enormous commercial real estate including farms, retail parks, and even shopping centers.

It even includes the world-famous Regent Street!

Surprised?

You should be, because Charles is now the owner of a real estate portfolio estimated to be at least $33 billion.

And he lives off the rent.

So if it’s good enough for the King, it’s good enough for you.

And since you’re probably not about to inherit a multi-billion dollar real estate portfolio, you’ll just have to get one started yourself.

My team and I are running FREE property strategy sessions over the next couple of weeks.

And we want to show you how you can do what the royals have done and create a real estate portfolio that replaces your income.

Curious?

Then book a time with us and we’ll take you through it.

There’s no cost for this and it could give you a solution to wanting to invest, without needing to lose money every month from negative gearing.

To your future prosperity,

P.S. You might be wondering why there’s no cost for this.

The reason is simple.

If we can show you a way to replace your income permanently through real estate then you might choose our help to implement it.

6 Jun 2023 - Should you pay off your home before you invest?

Hi,

It’s one of the biggest questions people ask me.

“Should we pay off our home before investing?”

And the answer is simple.

There’s no reason to pay off your home first. And it’s better if you don’t wait.

I can understand if you don’t want two loans straining your household budget.

But this doesn’t have to be the case.

There are ways to invest that put money in your pocket every month.

And you’ll be in a better position cash flow-wise than if you waited.

(How’s that for a paradigm shift?)

And that’s a huge help as rates keep marching upward, right?

Or it can help you overcome inflation by giving you more cash … and spending power.

And all the while …

… you’ve got TWO houses going up in value, making you wealthier and wealthier.

And that’s the other thing I’ll go through with you.

The sooner you get your first investment property, the sooner you’ve got an extra house going up in value and making you wealthier.

If you got a $700,000 investment property today and it doubled in 10 years, you’d be $700,000 wealthier by then.

But if you waited a decade until you paid your home loan off, you’d have missed out on all that money.

In fact, as your home and your first investment property go up in value, you can use this new equity to invest in more properties.

You could potentially be retired from your portfolio in that time.

But if you wait, what have you got to show for it?

No extra wealth … and you’re 10 years older.

So listen, if you’ve got big goals and ambitions for your life you can’t afford to wait.

The sooner you start, the sooner you’re on your way.

This week I’d like to offer you some time with one of our strategists to show you how this works.

Just straight talk about what’s possible, and no pressure to do anything so you’re calling the shots.

There’s no cost for this.

All I ask is if you like the strategy they show you, you consider asking us to help you implement it.

Either way, it’s up to you.

Let us show you how it works and what’s possible.

To your future success,

P.S. I’ve got one simple thing to ask you as a favour.

If you book a time with us, please make sure you’re available.

Our team works very hard with all our clients, and we’re giving you our time at no cost.

And if you need to reschedule, please let us know.

16 May 2023 - Delayed gratification … sucks

Hi,

Delayed gratification might be noble.

But it sucks.

The idea is you can lose money on an investment which is going up in value, and the increase in value of your property offsets your cash flow losses.

In other words, you’d happily lose $500 a month if you got a house which went up $30,000 in a year.

And OK, there’s some logic in that.

After all, it’s a small sacrifice today to have more tomorrow.

In other words … delayed gratification.

But the world’s moved on.

There’s reasons for this way of thinking too.

First, cash flow is as tight as a duck’s bum for most people today.

Interest rates continue to climb month after month and the cost of living is out of control.

Meanwhile, wages have barely moved.

And it’s no surprise that 71% of people never get beyond their first investment property.

The expense of owning it just isn’t worth it when you’ve got a family to feed.

This is why we’re often finding properties which are cashflow positive for our clients.

It means you won’t be out of pocket every month and your household finances won’t take a hit.

There doesn’t need to be decisions made over whether you buy that bottle of wine this week.

Or whether you’ll holiday closer to home this summer.

16 May 2023 - It’s a shame for you not to make money when this happens

Hi,

This story’s an oldie, but a goodie.

There’s a kid who gets sent to work in the horse stables.

It’s his first job so his boss gives him the nastiest, dirtiest job he can think of.

The boss comes back half an hour later to check on the kid, but instead of complaining about the back-breaking labour and the stench …

… the kid’s got a huge smile on his face and he’s singing away.

His boss asks him why he’s so damn cheerful.

And the kid replies …

“With this amount of horse poo, there’s gotta be a pony in here somewhere!”

Why am I telling you this?

Good question actually.

It seemed like a good way of telling you that industry experts are saying house prices won’t really rebound until all the uncertainty of interest rates are out of the way.

Bad news. Doom and gloom.

The usual!

Because the other way to read this message is that rate increases are nearly over.

There’s a boom coming.

And you can get on the front foot and get into the market now, knowing you’ll be riding this wave all the way to the top.

As an investor, your job is to go beyond the surface to understand what’s really going on.

And put together a game plan to turn it into a winner.

So when you want to play the smart game, let’s talk and I’ll show you how.

There are huge gains to be made just by thinking like that kid in the horse stables.

And unlike him, there really is something exciting about to emerge from all the doom and gloom.

Book a call with me and I’ll show you how.

To your future success,

P.S. Before you book a call, I want to let you know that this call is different.

I won’t even suggest what you should do until I know more about you.

The first thing we’re going to do is figure out the best strategy for you personally going forward because everyone’s different.

And this way you’ll get the outcome you want faster.

11 May 2023 - The budget’s biggest, scariest number is also the most exciting

Hi,

I knew it was big.

But I didn’t know exactly how huge it would be.

And one number from the budget means urgent action is required from you.

That number is 700,000 which is the number of immigrants expected to head here between now and the end of next year.

This means, if you own real estate you’re in the box seat because all these cashed-up immigrants are going to be squabbling over the tiny amount of real estate they can find.

To put this into context, the average household size in Australia is 2.5 people.

And this means another 280,000 houses will be needed.

Ouch!

To add insult to injury, the ANZ has put our housing shortfall at 250,000 homes already.

But given we’re on track for 153,000 this year, in the next 18 months, we’ll only build around 230,000 houses.

If we’re lucky with all the builders going bust at the moment.

And that’s way too few by miles.

Because you see, a lot of these new builds will be knock-down and rebuilds.

Others will be holiday homes or AirBNBs.

Plenty will be for population growth from our existing people too.

The point is, our housing market simply won’t be able to cope.

And that’s why this is urgent.

Right now you can get houses at excellent prices.

The market has bottomed out right now.

But soon rates are going to go into reverse.

And at the same time, we’ll be swamped with new Aussies looking for somewhere to live.

As more immigrants arrive, there’ll be less stock available for investors and more competition for any house which comes up.

Result?

This means the next few months are a golden opportunity to get in and get set before it all begins.

You can delay until then if you want.

But if you do you’ll be fighting for real estate with everyone else.

And, you’ll pay a lot more than you would now.

On the other hand, you can see what your options are and get set with the perfect investment (or two) before everything moves.

Listen.

Let’s chat about it.

You can book a time with me by clicking here.

We’ll talk about where you’re at and what might be possible for you.

And then my team and I will put together a strategy which is unique to your circumstances and goals to get you there.

No cost either.

We’re only looking at what’s possible for you.

Be quick though because things are going to move fast, and you won’t want to miss out on this.

To your future prosperity,

P.S. You might want to invest but you’re scared of high interest rates costing you too much money.

I get you.

We’ve developed a number of strategies for investors with returns that are higher than your interest and costs.

In other words, instead of being the victim of high-interest rates and inflation, you’re actually going to have more income thanks to your investment.

Curious to know how this could work for you?

Then click here and book a time with me and I’ll take you through your options

14 April 2023 - The case against real estate investing

Hi,

If you invest with MOST real estate companies you’re almost certainly being taken for a ride.

All they do is push you into negatively geared, overpriced house and land packages miles from anywhere.

And this means, not only is your investment barely going up in value …

… it’s costing you money each month.

(Yay! You get a tax deduction, but when you have to lose $1 to get 35 cents back it kind of stops making sense).

So if you’re talking to these clowns, there’s a strong case for NOT doing anything at all.

Listen.

There are lots of different ways to invest.

From new and old houses, apartments, townhouses, duplexes, airBNB, even NDIS and defense housing.

Each has its merits and its drawbacks.

But I can guarantee you there will be one which fits your current situation like a glove.

We take the time to work out what’s best for you.

No cost, just a chance to see if we’re a good fit for each other.

One thing though, if you can grab a price estimate for your house it’ll be a big help for when we chat.

Click the button, enter your details and I’ll send the report to you.

Then I’ll give you a call and we’ll set up a time to go through it properly.

To your future prosperity,

P.S. Yes there are a few different ways to invest.

But you won’t be tied into one strategy forever.

Sometimes you’ll use one strategy to get yourself to a different type of property next.

What we do is create a 5-year plan to get you to your goal faster, and it often uses different types of properties.

Anyway, I’ll explain when we talk.

14 April 2023 - Property investing can BEAT interest rate rises?

Hi,

Anyone with a brain knows that property owners are suffering right now.

The more houses you have, the more you’re getting pounded by interest rate rises and inflation.

Well, most of the time anyway.

Only it doesn’t have to be this way.

There are ways to use real estate to get ahead of interest rate rises and inflation.

How?

You use a special type of strategy where your income from the property exceeds your expenses.

It’s pretty simple, but most people don’t get past negative gearing.

Only it’s not negative gearing where you lose money every month.

It’s the opposite.

You invest … and now you’ve got more income every month.

The more you invest, the higher your income.

And that’s what investing should be about, right?

This means if you’ve got a mortgage and it’s killing you then this takes the pressure off.

Or if the cost of living is driving you to the brink, this can give you more money to spend each month.

Yes, it’s totally the opposite of what you’ve always been told about real estate investing.

But it’s real and it works.

Listen, this isn’t for everyone.

There are a whole range of strategies, and everyone’s situation and goals are different.

But for the current market, these cashflow strategies might be perfect.

Anyway, I don’t tell people what they should be doing unless I’ve spoken to them to make sure it’s the right thing.

So let’s set up a time to see what works for you.

First things first, so I know your current situation, can you get an estimated price on your current home?

When we talk, we can use this data to get a rough idea of what’s possible for you.

Put your details in and I’ll send you a report with an estimated value of your property. And then I’ll give you a call to set up a time to go through your options.

To your future prosperity,

P.S. If case you have an investment property instead of a home you live in, put that address in and I’ll get a report on that one for you instead.

Either way, it’ll give me a good indication of where you stand.

9 Mar 2023 - Insane crowd only proves real estate is where the action is

Hi,

If you were wondering if real estate is still where the action is, you should have been in Surry Hills in Sydney last week.

Over one lunchtime, a 2 bedroom apartment was opened up for viewing with …

… over 100 desperate renters lining up for a chance to see inside.

Crikey!

That’s a crush not seen since the Ed Sheerin concert at the MCG.

In fact, it was so crowded that potential renters couldn’t even see what the place was really like.

And even though the asking rent is $720 a week, chances are the landlord will snag at least $820 a week because applicants know to offer $100 a week more if they want to be considered.

Now, if you think this is an exception, think again.

Would be renters are cramming themselves into house inspections all over the country.

And rents are through the roof.

Tough it you’re a renter.

But if you’re an investor it’s your time to bring in the money.

The question is … could you join this party?

Well, there’s a way of finding out.

I’m offering you a FREE price estimate for your house.

Nobody needs to go through your home.

And it’s surprisingly accurate.

All you have to do is click the button below, enter your details and your address, and we’ll run the report and send it to you.

Then to find out where you stand, reply and let me know how much you owe on it and I can use these two numbers to see how much you might be able to get your hands on to invest.

Naturally, it depends on other factors.

But it’s still a good first-up indication of what’s possible.

To your future prosperity,

P.S. It sounds greedy to be talking about making all this money.

But the reality is, that’s just how it is right now.

You didn’t create this situation.

You didn’t cause the housing shortage.

But since it exists, you may as well take advantage of it while the going’s good.

And you’ll be putting a roof over someone’s head at the same time.

22 Mar 2023 - Before you get angry at Albo … do this

Hi,

There’s been red-hot rage at Albo and the government lately as they double the tax rate on super funds worth over $3 million.

But before you get the pitchfork out and light the straw torch … make sure your anger is directed at the right place.

And by that I mean …

… if your super isn’t on track to be over $3 million … don’t get angry about a tax cut which won’t affect you.

Get angry about your personal situation instead.

And do something so you WILL have over $3 million in there.

(Then sharpen the pitchfork!)

Listen.

I’m showing people how it can be done all the time.

What it takes is the right mindset, strategy, and dedication.

However, there’s one more ingredient.

Time.

If you start one year from now, it’ll be one more year before you make it.

So don’t sit on your hands.

It’ll make a huge difference down the track.

Let’s find out where you stand right now.

Click the button below to request a FREE house price report.

It’s an estimate produced by Australia’s leading property data company on what your house is worth.

Sure, it’s only an estimate but we can use it as a rough starting point.

Then once you’ve got it, flick me an email with how big your mortgage is and we’ll see what might be possible for you.

To your future prosperity,

15 Mar 2023 - Why investors should ignore interest rate rises

Hi,

I’m going to take one of Investing’s sacred cows and slaughter it.

It’s that interest rate rises that make it a bad time to invest.

Sure, everyone panics when they go up.

Especially when it’s been 10 hikes in 11 months.

(At least they gave us a break over Christmas).

But the reality is, you shouldn’t pay interest rates as much attention as you do.

Over the life of your investment, rates are going to go up.

And then they’ll go down.

And then they’ll go up … and down again.

Invest when they’re going up and you’ll pay a bit more.

But then you’ll get to enjoy paying less as the cycle reverses.

And next time, because your rents are going up too, it won’t even matter as much when they start rising again.

To me, and to other successful investors, interest rates are just background noise.

They’re just part of a cycle which runs along in the background.

We’re not excited when they go down because we know they’ll go up again soon enough.

But on the other hand, we’re not upset when they go up because we know they’ll fall soon after.

And you can put your worries about rates on the back burner.

Makes you think, right?

To your future prosperity,

P.S. Want to know if you could invest?

Chances are you could be in a position to right now.

First, let’s work out how much equity you have at your disposal.

Click the button below and we’ll send you a FREE property estimate by email.

Then, reply and let me know how much your home loan is against it, and that’ll give us a rough indication of what might be possible.

8 Mar 2023 - The death of Australian real estate?

Hi,

It was Mark Twain who famously said …

“The reports of my death are greatly exaggerated”.

Touché!

It’s the same with real estate.

Despite the hysteria about house prices …

… they only fell 3.9% since their peak in March last year.

Yeah, I know. Why was everyone running about like Chicken Little, screaming about the sky falling?

And that was after a whopping 22% increase the year before.

Now, let me talk to you about something even more important.

Current conditions are a bonanza for investors.

I’ll be quick.

- Cashed-up immigrants will add more fuel to the fire as they fight for the limited supply of houses. Almost 200,000 new migrants are heading here this year.

- Rents are through the roof, with Westpac tipping an 11.5% rise in rents this year. If you’re worried about being negatively geared, don’t be. Especially as …

- … interest rates peak, then drop. Probably as soon as the end of the year

- Supply is still critically low. Materials are being fought over. I heard yesterday that building companies aren’t even waiting for their containers from China to be filled. They’re instructing the exporters to send them half-empty just to get their hands on the damn materials. And I can’t see a jump in new supply coming any time soon. And no materials means no new houses.

- And inflation’s going to start to fall, most likely around mid-year which will get buyers back into the market

Smart investors are looking at what’s going on without any emotion.

They’re analysing and assessing what they see.

Are you able to join them?

Let’s find out.

First step … find out how much your house is worth to get an idea of your position.

And then let’s take a look at what your options are.

This is too good an opportunity to miss.

If nothing else, find out where you stand so you can assess your options.

To your future success,

1 Mar 2022 - Money lessons from the world’s roughest sport

Hi,

If you want to be wealthier, don’t listen to your financial advisor.

Surprisingly, the advice from the world’s greatest ice hockey player could be far more valuable.

Canadian Wayne Gretzky is considered the best player ever.

And he’s also famous for saying …

“I don’t skate to where the puck is, I skate to where it’s going”.

Listen.

Most investors look at the market now, and what do they see?

House prices falling.

Rates rising.

Economy shrinking.

You’d be nuts to invest in that, right?

WRONG!

If you think this, you’re looking at where the ice hockey puck is now.

Not where it’s going.

Plus inflation returning to around 4%.

And do you know what happens when rates fall?

House prices go up.

This is why smart investors are getting into the market now.

They’re seeing bargains everywhere and jumping them, knowing it won’t be long before rates fall, their house prices rise, and as a nice little bonus …

… their repayments go down too so their cash flow improves quickly.

They know where the puck’s going, and they’re skating there.

Perfecto!

The question is, how do you begin?

You begin by getting an accurate picture of where you are right now.

And the first step is to get a FREE house price estimate from us.

We secure this information from our data analysts, and along with how much your mortgage is on it (if any) we can give you a rough indication of what’s possible.

This is exciting and golden times are around the corner.

Get in now and ride this all the way to the next peak.

To your future success,

P.S. If Westpac is right and there are 7 rate decreases even of just 0.25%, what does this mean?

It means if you buy a $700,000 property, your repayments fall $12,250 a year which is …

… $1,000 more in your pocket a month.

Don’t wait until prices have already moved though.

Start the investigation process now and we can help create a strategy to help you succeed as the market changes.

23 Feb 2022 - This Power-Group won’t let property fall. This is why …

Hi,

A lot of people still think investing is risky.

And OK, there are some risks involved.

But if you think the biggest risk is a market crash then fear not!

Because there are two groups who secretly can’t let this happen.

And they’ve got the means to make damn sure there won’t be a crash.

Listen, I’ll let you know about one of the groups today.

And I’ll email you again in a couple of days to tell you about the second.

The first group who you should consider your partners or your backers are …

… the good old Aussie government.

There’s also the slight issue of an economic collapse if house prices plummeted.

You see, if values collapsed, construction would stop.

And one of our largest industries would stop work and head to the dole queue.

Result?

Financial Armageddon.

(Forget house price falls if you’re a first home buyer. They’ll just let the prices rip while making vague promises to maybe do something sometime).

Plus if house prices fell, nobody could borrow against their homes.

And that’s a huge chunk of money which wouldn’t flow back into the economy too.

Plus … if people get poorer during your term in power, they’re not happy.

And people vote with their wallets.

See why the government is behind you 100%?

With them as your partner, you’d have to be pretty confident.

Anyway, that’s it for today.

In a couple of days, I’ll share with you another group who can’t afford prices to fall.

And I reckon they’ve got even more at stake than the government.

And more clout to stop it happening too.

To your future prosperity,

P.S. Have you claimed your FREE property report yet on your house?

It’s a detailed look at your property and your area.

You’d normally have to pay for this CoreLogic report, but thanks to our relationship with them we can get you one for free.

Click the button, enter your property’s details and we’ll send it to you.

7 Feb Dec 2023 -[Wealth tip] Never let your bank do this

Hi,

Something every dad can relate to is being handed a big tangled mess of wires, or a shoelace or a necklace by your kids.

And being asked to fix it.

It’s a nightmare to untie!

Well, one of the sneaky tricks the banks get up to is called cross-collateralisation.

It’s where they tie up all your home loans into one big mess so it’s almost impossible to untangle.

The banks love it because they can tie you up so badly that they own you.

It’s called cross-collateralisation and it’s their favorite trick.

What they do if you’ve got more than one property is they let you borrow the second using the equity in the first.

So the first is now security for the second.

And then the first and second become security for the third.

Sounds like a good idea because as long as you’ve got equity you can get the next place.

But it’s an EPIC disaster.

Because they can make it impossible for you to do what you want down the track.

If you want to refinance, even one property with another bank you have to value the whole bundle first, and then work with them to untie the one you want to move.

If you want to sell one, same deal.

And if they won’t let you borrow … it’s almost impossible to get away to another bank.

I remember one of my clients who came to me like this.

He had 5 properties, all cross-collateralised by one of the big banks.

We needed to separate them so we could take him forward.

There was $600,000 in equity we wanted to access.

But it took us months and $20,000 to get the job done.

See why I call it a disaster?

Listen.

There are ways you can avoid this.

And the easiest is to create a new loan or a line of credit against one of your properties.

Then you take this money and use it as a deposit for your next property.

It’s neat and nothing is crossed over.

Anyway, this is a job for a mortgage broker.

Right now it’s worth you seeing what your position is to assess your potential to move forward and invest.

Grab a copy of your FREE property report.

It’s individualised to your address and will give you a really good idea of where you stand.

[FREE Property Report]

We’ll run your report and get it back to you within 24 hours.

To your future prosperity,

7 Feb Dec 2023 - The greatest wealth ‘hack’ ever?

Hi,

Legendary success coach Earl Nightingale once said if you’re trying to figure out what to do, and you’ve got nobody to give you advice then …

“Watch what everyone else does and do the opposite. The majority is always wrong”.

Great advice, right?

What he was saying is that most people are wrong.

Do you think he’s right?

Most people aren’t wealthy.

They aren’t fit and healthy.

They aren’t enjoying great careers, businesses, or loving life.

If all you did was watch what they did and do the opposite you’d be flying!

Listen.

Or they plan to ‘get in later’.

Or they think their superannuation will be all they need.

So if you believe most people are wrong (and there’s a good argument that they are) then your plan should be to get into the market.

Our clients are creating wealth at the moment.

Our clients have been creating wealth for a long time in fact.

And they’ve done it when the masses have stayed away.

I want you to join them.

The first step is to find out what your property is worth.

[FREE PROPERTY REPORT]

And then let’s use it to see what you can achieve, and how quickly.

To your future prosperity,

30 Jan Dec 2023 - Never invest in this suburb

Hi,

Facts don’t lie.

And location IS important.

Plenty of property spruikers will tell you that some future brand-new suburb is a great location …

… despite it being a dustbowl with a few pegs in the ground marking it out.

Listen.

There are factors that make a suburb popular.

And therefore drive capital growth.

Generally, these are existing infrastructure, lifestyle factors, and jobs.

While they can turn into thriving communities in the future, you can expect to wait 10 years or more to see if the promise comes true.

And you can’t afford to wait this long.

This is why we choose where our clients invest carefully.

And why brand-new suburbs should be avoided at all costs.

BTW have you ever wondered how your suburb stacks up?

Then get the facts with this FREE suburb report.

They’re usually not free, but our subscription with SQM Data means we can offer you a complimentary one for your interest.

Enjoy!

To your future prosperity,

P.S. You’ll be fascinated with your suburb report.

What SQM Data do is track and report on all sorts of information you’d never know about where you live.

And they give an assessment out of 5 for how your suburb stacks up as a place to invest.

Click the button above and get yours now.

30 Jan Dec 2023 - Is now a good time to invest?

Hi,

Inflation is up.

Interest rates are up.

Every except is up except confidence which is way, way down.

So does this make it a bad time to invest, or a good time?

Most people think it’s a bad time, however, surprisingly it’s actually the perfect time.

Because when people are scared there are bargains galore.

And with our economy fundamentally strong, unemployment at rock bottom, immigration roaring back and a chronic housing shortage it’s probably the best time in years.

We’re helping people get set in high-growth suburbs right now at massive discounts.

This means they’re building in profit from day one, and securing a fantastic deal in a great location.

As the legendary investor, Warren Buffett said:

Right now the market is scared.

And it’s time to be greedy.

To your future prosperity,

P.S. The best way to get a feel for whether you can get into the market is to know what your house is worth.

If there’s a big difference between what it’s worth and what you owe on it, you can use this to get into real estate without needing to sell it.

Your first step is to click the button and request your FREE property report.

Then let us know how much it is, and how much you owe on it and we’ll be able to give you an indication of how ‘greedy’ you can be in this incredible, bargain-filled market.

24 Jan Dec 2023 - Should you pay off your home before investing?

Hi,

It’s one of the great questions people have about wealth creation.

Should you pay off your home loan before investing?

So, let me give you a straight answer.

In almost all cases, it’s a yes.

Well, for a couple of reasons.

First – waiting means missing out on a whole lot of capital growth.

If you have 10 years left on your home loan and you wait … the property you could have bought would likely double in value during that time.

OK, so let’s say you choose to wait.

And you choose not to invest in a $600,000 property now.

Well, by the time your home loan is paid off that house could easily be worth $1,200,000.

And you missed out on $600,000 worth of capital growth.

Plus the opportunity to use the equity from it to purchase other properties.

(This is called opportunity cost BTW. It’s the cost of what you could have done with the opportunity had you seized it).

In other words, the sooner you begin the sooner you start creating wealth.

And now the second reason.

Second – You’d have seen huge increases in rent.

On average rents soared 6.7% in the last year alone.

And it looks like rents will continue to go through the roof for a long time to come yet.

This means, depending on your strategy you could be cashflow positive very soon.

Maybe even from day one.

And when you’re cashflow positive, it means you’ve got more money coming in than going out and your income is increasing.

That’s right, your income is going … up! Which can actually help you pay your home loan off faster.

See?

The odds are you’ll be better off investing now than waiting.

In fact, when you do the numbers you could be better off to the tune of hundreds of thousands of dollars.

Maybe even a million or more.

Either way, it doesn’t hurt to ask the question.

Your first step is to work out how much you could borrow.

What I’d like you to do is click here to get a free property report.

It’ll give you a whole lot of valuable information including an estimated value of your home, plus comparable sale prices from your area as well as a listing history and rental history.

Then, once you’ve got it I’d like you to email me the estimated value, plus how much you owe on it (roughly).

This will give me a good indication of what you could potentially borrow and we can talk about your options from there.

To your future success,

P.S. What I’m saying is the sooner you get in, the sooner you’re growing your wealth and your income.

The most successful people I know take action on multiple things at once.

They don’t believe in sequential.

They don’t get their home paid off before starting something else.

They do it all at the same time because they know if they’re going to create wealth, the sooner the better.

Click here to get a free property report and let’s find out where you stand

19 Dec 2022 - Why I’m taking calls over Christmas

Hi,

I know Christmas and the New Year is a time to finally relax.

Maybe to go sit on a beach all tensed up for two days before your muscles and your brain finally eases.

Or go chill with the kids while the sweet sound of ‘Are we there yet’ and ‘Can I have the iPad … it’s MY TURN!’ take all your troubles away.

Well, I’m too old for that now.

But either way, I’ve decided …

… I’m not switching off this year.

Easing down, sure.

Lots of admin work around the office is just going to gather a bit of dust for a couple of weeks.

But one thing I’m not stopping is taking your calls.

Same with my team of strategists.

Why?

Because this is the time of year when money raises its head.

I mean, it’s pretty obvious if you’re not traveling all that well right about now.

Seeing everyone else on expensive holidays, buying extravagant gifts, and jumping in and out of their swimming pools.

So here’s what I’m doing.

I’m making myself, and a couple of my strategists available every day apart from Christmas Day and New Year’s Day to have a chat with you.

What happens first is you jump on a quick call with me to set a time, probably around an hour or maybe a bit less.

And then one of my strategists or I will talk to you about where you are, and where you want to go and give you some guidance on how you can get there.

You probably won’t have time when work goes back.

And the urgency will probably drop until next Christmas.

So strike while the iron’s hot.

Let’s get started, we’ll have a chat and see what’s possible for you.

Talk soon.

To your future prosperity,

P.S. This chat is simply for you to understand your options and see what’s possible.

Maybe once you think about it, you’ll decide to ask for our help to put it together.

I hope you will, assuming we work something out which works for you.

But that’s up to you.

It has to make sense for you to move forward.

See what your options are – taking calls over the Christmas – New Year break (no cost for this)

12 Dec 2022 - Do you hate Christmas?

Hi,

According to popular culture, we all LOVE Christmas, right?

I mean, carols, presents, family.

A-rum-pa-pum-pum.

The best time of year apparently.

Well, I love Christmas but a lot of people don’t.

According to some research from the USA (yes, I know) some 38% of people find their stress levels increase around Christmas.

No surprise there.

And I reckon it’s similar in Australia too.

So if you hate Christmas, don’t worry.

You’re not alone.

One of the reasons of course is good old money.

Or more to the point, a lack of it.

Not everyone has enough for the big Merry Christmas, the tree surrounded by presents, the massive feast, and all the good stuff.

Money’s tight, businesses shut down, and you’re forced to take time off.

Same with taking the kids to the greatest, funniest places like their friends’ parents are taking them to.

Or what everyone on Facebook and Instagram is doing with their kids.

Of course, it’s nothing to be ashamed of.

We’re all on different journeys.

Even though I’m now doing great financially, I’ve had my rough times too.

However, this doesn’t mean you can’t do something about it.

In fact, I encourage you to find a way to get yourself to a new level money-wise.

It’s what I did.

And it’s what our clients are doing too.

They’re taking steps to improve their position so next Christmas is better.

And the one after is brilliant.

I’m sure I can help you too.

Let’s talk about it and see where we end up.

Click here and set a time with me for a chat.

Where will we end up?

Nobody knows, however, one thing is for sure, and it’s that you’ve got nothing to lose and everything to gain.

There’s not even a charge for it.

To your future success,

P.S. Christmas can be a great time to reflect, both good and bad.

So if it’s stirring feelings, positive or negative then listen to them and let them guide you.

It’s the best thing you can do.

5 Dec 2022 - Economics explained – with a bag of mixed lollies

Hi,

The last time I said this in an email, someone replied back and told me I was a F&#%wit.

Yep, a troll of my very own (until I removed him permanently from my email list a second later).

But … was he right?

The reason he got so upset was because I said that inflation was, in a lot of ways a good thing.

It’s not good for everyone of course.

It hurts a lot of people.

However, as an investor, it’s a recipe for becoming wealthier faster.

Want to get wealthier faster? Click here to book a FREE strategy session with one of our strategists

Leading economist Chris Richardson explains why.

“It’s an old story – if you owe a lot of money, and there’s a burst of inflation, you’re a winner, because if you’ve got big debts, you get to pay it back for effectively cheaper, with depreciated money.

“So Australia’s government debt looks less dangerous than it used to. We see this is happening all around the world – the biggest borrowers also are the biggest winners out of inflation.”

Now, it’s admittedly not the clearest explanation.

But what he means, in a nutshell, is this.

Inflation makes your money worth less.

Let me explain in a slightly different way.

Years ago you could go down to the shops with 20 cents and get a bag of mixed lollies.

Chocolate buds, freckles, teeth, raspberry drops.

You’d come home with a pretty big haul.

Today that same bag would probably be $2.

You see, back then 20 cents seemed like a lot of money.

Today it’s the loose change which barely buys anything.

This is why people who borrow money love inflation.

If you’d borrowed 20 cents all those years ago it would have meant something at the start.

But today it’s almost nothing.

The more inflation there is, the more the value of your debt shrinks.

When you borrow money, your loan is not YOUR asset.

It’s the bank’s asset because it’s money you owe them.

And inflation is effectively making it smaller.

(They lose, you win).

So on one hand the house you invested in is being pushed up by inflation.

While on the other hand, the amount you owe is being pushed down, once again by inflation.

And this makes you, the investor the big winner!

I hope this makes the reason investors love inflation clearer.

To your future prosperity,

P.S. I’d love to get one of my team to show you how this works in real, practical terms.

We’re offering a few strategy sessions to show you how you can leverage real estate and inflation to achieve your goals sooner.

If you’re not 100% clear on where inflation fits into the picture, and how you can use a few other market forces to increase your wealth and cash flow then this time (which is free) will help enormously.

I’d hate you to miss out on a huge opportunity because you weren’t clear on something.

Take up my offer of a strategy session with one of my team and discover what’s possible.

Click here to book your FREE session with one of our strategists

29 Nov 2022 - : Read this if you’re 38 or older

Hi,

Interesting … and perhaps a little confronting stat for you.

The median age of Australians is 38.

Which means if you’re under 38 there are more Aussies who are older than you.

However, once you’re 38 or older, there are officially more people who are younger than you than older than you.

You’re in the back half and one of the ‘oldies’.

Kinda scary, right?

(Maybe we should be celebrating 38th birthdays instead of 40th.)

Either way, if you’re 38 or you’re older you need to seriously think about what the rest of your life looks like.

One warning … if your finances aren’t in order things aren’t looking all that rosy.

And now you’re in the older half, it’s time to get things moving, and probably fast.

When you’re young it’s easy to create wealth.

High incomes, low expenses – especially before kids.

Plus plenty of time.

But now?

You’re paying way too much tax.

And with groceries, food, the car loan, school fees, insurance, and on and on and on … things probably feel like they’re closing in on you.

This is why if you’re 38 or over you should take me up on my free strategic plan.

Click here to get your strategic plan underway

It’s where we look at where you are, where you want (or possible NEED) to go.

And how you can put your money to work for you so you can begin building the wealth you need in the coming years.

You’re heading into the best years of your life.

Make sure you’re set up financially for them.

To your future prosperity,

P.S. When you click on the link you’ll be able to book a time with one of our advisors.

Your first call will be a quick call to schedule a strategy review which we call ‘What Can I Do Next?”.

It’s a look at where you are and where you want to go so we can let you know what your next moves should be.

Click here and let’s get started – there’s no cost for this either

20 Nov 2022 - Why people start investing in their 40s

Hi,

Why do people start looking more seriously at the property in their 40s?

I’ve noticed there’s a decade where the property switch is often ‘turned on’ in people’s heads.

And sure, it can happen at any age.

(The younger the better of course, however, the key is to just get started).

However, when people hit their 40s their focus suddenly switches.

And they suddenly come and talk to us about creating wealth.

Why does this happen?

Overall it seems to be a factor of a couple of things.

First, life’s beginning to be a bit of a drag.

Family, school fees, and the huge mortgage.

And I’m not saying they don’t love their family. They do! They love their home too.

But then you throw the taxes on top. They loathe seeing how much of their wage goes to the government to waste on another overseas trip or some other stupid nonsense.

Then add rates, insurance, rego, and all those on top.

It’s a drag alright!

So they tighten their belts and spend less.

Give up on their dreams a bit more.

And one day they wake up and realise …

… “This isn’t what I had in mind when I was 25!”

It’s not what I promised my spouse when we married.

I had huge goals in mind and my life kept getting greater and greater.

And now all that’s happening is I’m getting older.

Now, here’s the other thing.

Career? Well, by the time you’re in your 40s if you’re not on the golden escalator to the top floor, it’s probably not going to happen.

And you’ve probably seen all those hungry, aggressive kids on their way up.

If you’re not on the fast track, it’s probably not going to happen.

Besides …

… who really wants all that stress, butt-kissing, and stupidly long hours anyway.

Hardly worth it, right?

Especially when so many top execs have crappy marriages and barely ever see their kids.

So that brings us to your investing options.

Shares, rising at 8.1% a year is slow, volatile, and risky.

Besides, you need cash to put into shares, and there’s not that much left over.

Same with managed funds too.

Actively trading is even riskier, and time-consuming and the learning curve is enormous.

Then there’s starting a side business – think trading multiplied by 10.

And suddenly.

BAM!

You only have one real option left.

Fortunately, it’s the best one.

Investing in real estate!

So listen, maybe this sounds like you.

Perhaps a few bits ring true.

If so, when you’ve come to the conclusion that you need to do something, and your options are closing off then it’s time to talk to one of my advisors.

We’ll look at where you are, where you want to be and see how we can finally close the gap.

Plus how quickly it could be done.

Click here to chat with one of our advisors.

They’ll have a quick chat with you to go through a few basics with you.

And then book a time for a ‘What Can I Do Next?’ call where we really dig into your strategy.

This is all about rescuing your future.

And there’s no cost to you to do this.

To your future prosperity,

P.S. These calls aren’t sales calls.

They’re 100% about your options.

You might want to get our help to implement all this, and that’s entirely up to you.

Our job is to make sure your direction is clear, and that you understand your options and your next step.

After that, it’s up to you whether you do it yourself, with us, or with someone else.

Click here to begin your strategic review. No cost to get this done

6 Nov 2022 -Crappy lesson from Elon Musk

Hi,

If you want to predict the future, you need to study the past.

This is because history just keeps repeating itself over and over again.

And I could scare you and say we’re seeing the same situation which caused the Global Financial Crisis in 2008.

But this time it’s only contained to the crypto market.

And as an investor, it’s important you get a good, wide feel for economics.

So I thought I’d give you a quick insight into what’s going on.

What’s happening?

Well, just like in 2008, it started with a lack of oversight.

An industry left to regulate itself decided that ‘Greed Is Good’ and being responsible is kind of boring.

Not to mention a lot quicker to get rich.

So there have been new financial products (and I use the term loosely) created in the crypto market.

Just like the collateralised debt obligation (CDO) and the synthetic CDO which were being made up out of thin air before the GFC.

These were basically smoke and mirrors which were turned into real money, only with nothing behind them.

Everyone seemed to own a bit or a lot.

And nobody really knew who had what.

Then when the bath plug got pulled, we got to see who was swimming naked.

As it turned out, it was a lot.

Over the past 12 months, the bitcoin market has plummeted around 75%.

And news of more exposure to risky schemes is coming out all the time.

Avoid the hype and the get-rich-quick schemes.

Because if it seems too good to be true?

Well, it probably is.

Enjoy your week.

To your future prosperity,

P.S. We’re helping people create a great future without taking dumb, irresponsible risks.

Because just like history repeating itself, the real estate market repeats itself too.

Only it’s far more stable and delivers consistently high returns.

And you can tap into it to create a great future for yourself.

We’re running some FREE wealth sessions for you to find out how.

And you can apply to get one by clicking here.

6 Nov 2022 -Crappy lesson from Elon Musk

Hi,

I love it when the world’s absurdly rich folk drop some gems of advice.

Warren Buffett does it in his annual speech.

Richard Branson and Bill Gates drop brilliant truth bombs in their books.

Steve Jobs’s vision was there for the world to see and get inspired by.

But Elon Musk?

Well, there world’s richest person just delivered a life lesson which was anything but inspiring.

He took over Twitter.

And sacked half the workforce.

Inspired?

No.

Me neither.

However, while you might not be inspired …

… you should find it damn well motivating.

Because while you might not have been part of the Twitter chop, you might also realise that your job isn’t safe either.

Businesses go down the gurgler all the time.

People get downsized.

Replaced.

Merged out of existence.

I’ve heard too many stories of people turning up for work on Monday morning only to find the gates locked, an apology note and the owners nowhere to be found.

So listen.

You might think investing is so you can get rich and be financially free.

And sure, that’s a good reason for it.

However, it’s also a ‘Get Out Of Jail Free card.

Done right, it could be what saves your financial bacon right when you need it the most.

Or $600,000 in equity you could tap into and do something with.

This could be a financial lifesaver, right?

If you’re going to learn anything from Elon Musk it’s that you can’t take anything for granted.

And you need a Plan B.

Let’s talk about it.

I’ve got some time coming up with my strategists to show you how you can create financial freedom and protect your backside at the same time.

Click here to book a time to talk (it’s free)

Do it and let’s see what’s possible for you.

To your future prosperity,

P.S. Don’t regret not doing something about this.

You might be feeling pretty comfortable right now, but you know how fast things change.

It might not even be losing your job which leaves you in financial strife.

It might be a health issue or some other kind of personal problem which needs you to have access to money.

Don’t get there and regret not having protected yourself while you could.

Let’s talk and find out where you stand.

Click here to book a time to talk and let’s find out where you stand

31 Oct 2022 - Dumbest government on record?

Hi,

I don’t care if you vote red or blue.

Or teal, green, or … yellow for that matter.

But you have to admit.

The government led by Anthony Albanese is shaping up to be the dumbest on record.

And the reason I’m being so harsh is they took a MAJOR economic task …

… and turned it into a 3 Stooges style sideshow.

The announcement I’m most dumbstruck by is the plan to build 1 million new homes in the next 5 years.

Let’s take a look at the sheer idiocy of it piece by piece.

First, they haven’t actually said if it’s 1 million EXTRA homes or just 1 million homes in general.

Hardly a minor detail, right?

But since they haven’t said one way or the other, they probably don’t know yet.

And if it’s just 1 million homes in total then that’s pretty basic because we’re already building 200,000 homes a year.

And basic maths is … 200,000 x 5 years is 1,000,000 homes.

If that’s the case then ummmm … they’ve just announced something which is already being done.

Okie dokie.

Now, if it’s EXTRA houses, then that’s not a policy they have even a hope of achieving.

Not even close.

There’s no tradies.

Or materials.

And sure, we’re going to increase immigration and hopefully find some tradies in there.

Plus once China gets over its Covid-Zero obsession and lets people get back to work then the material supply will pick up again.

Mind you, the building industry isn’t full of hope.

In fact, building approvals are actually FALLING at the moment.

And a few months ago, Metricon unceremoniously sacked most of their sales staff in NSW, with more likely to go to other states.

I guess they figured there’s no point paying people to sell homes they cant build.

So it begs the question …

… who’s going to build these million homes?

And what are they going to build them from?

Right now we don’t even know the details.

We don’t even know if it’s really a million new houses.

Or simply a bit of smoke and mirrors.

Anyway, who cares?

If you know anything about real estate, you know we’re at max capacity, and nothing the government promises is going to make a scrap of difference.

To your future prosperity,

P.S. [Usual PS here]

23 Oct 2022 - The perfect catch-up plan

Hi,

Are you financially behind the 8-ball?

This is when you’re not quite where you feel you should be.

And it’s all too common.

Perhaps you dreamed you’d be way up the career ladder by now.

You’d be earning a lot more.

Probably have the home loan paid off by now and have a few high cashflow investments tucked up your sleeve making live fun.

But maybe things didn’t pan out this way.

Listen, no matter where you are in life there’s a great chance it’s not too late.

It’s not too late – click here and let’s turn this around for you

You can still turn this around.

And in fact, not just catch up to where you should be but go straight past it.

Go chasing shiny objects and empty, hyped-up promises and you know what will happen?

You guessed it.

You’ll be one year older … with one year less to get yourself ready.

And one year less time in the market to grow your wealth.

You can’t afford to get this wrong.

It’s why you should start with a plan, not pie-in-the-sky promises.

Get the plan right, and I mean REALLY nail it, and everything else falls into place.

All the steps become clear.

You know what to do next.

And you can see it all coming together before your eyes.

So, let’s get this started.

I want you to book a time with one of our strategists who will show you what’s possible, and the series of steps to get you there.

The journey of a lifetime starts with a single step.

And your first step is this one.

Click here to take your first step on your financial turnaround.

Take the step, and see where it takes you.

No charge, and if you don’t like it you don’t have to take the next step.

You’ve got nothing to lose.

To your future prosperity,

16 Oct 2022 - The harsh reality of school reunions

Hi,

Do you do school reunions?

They’re a strange phenomenon because while they’re supposed to be a fun catch-up with old friends … they often hold up a very confronting mirror to our lives.

10 years in, you might be tearing life apart and on the path to mega success and stardom.

But by your 20 year reunion, and especially your 30 year reunion things start to hit home.

The old car you turn up in.

The clothes you’re wearing might have fit OK when you bought them, but that was 7 years ago.

Your career?

The suburb you live in?

Your last holiday?

All confronting truths that things haven’t quite gone as well as you thought they would.

And it can be a little bit embarrassing.

Listen.

We all started out with big dreams and ambitions.

We probably imagined a soaring career, big paypacket, and an upgrade to the dream home.

But then life got in the way.

Maybe your career stalled.

You lost out in the latest round of office politics.

Or perhaps you followed a career path you were more passionate about, despite the pay cut.

Then there’s the kids coming along plus a few financial bombs thrown into the mix.

And the future ‘you’ which you imagined at the end of high school never quite happened.

Listen.

I get this.

It’s one thing to dream about a grand future, but the realities of life always get in the way.

We’re working with people just like you.

And we’re giving them a way forward to bridge the gap between where they wanted to be … and where they are.

This is for you if you’re not comfortable with where you’re at.

And you always thought you’d be further forward than you are.

Your first step is a quick exploratory call with one of our team.

It only takes 15 minutes.

And they’ll set a time with you to help you prepare a path forward.

Best part?

It’s free to do this.

And it’ll give you clarity on your next moves like you’ve never had before.

Click here – it’s not too late. Let’s get you finally back on track

If you’ve been in the wilderness all these years, now is your opportunity to get back on track, and fast.

To your future prosperity,

9 Oct 2022 - The government has screwed you over

Hi,

Most Aussies are in dire financial straits.

And it’s the government’s fault.

Their actions over the last few years have really screwed us all over.

I guess that’s what you get when your choice is a bunch of fast-talking lawyers on one side.

A bunch of trade unionists on the other.

And not an ounce of real-world experience or economic ability in sight.

Today the cost of living is out of control.

Rates have gone up 6 months in a row.

House prices are going through the roof.

And so are rents.

The wild and unrestrained money printing during Covid has left us with mind-boggling levels of debt we’ll never be able to pay off unless the basics get slashed.

And because they’ve messed up so badly they’re punishing YOU by not letting you even get the pension until you hit 67.

Goodbye, pensions, quality healthcare, and a comfortable living.

So listen.

Unless you do something, and do it soon there’ll be no safety net when you retire.

Most Australians have far too little super.

And virtually no decent investments.

Which means no matter how hard you’ve worked, you have to take responsibility for rescuing your financial future because nobody else will.

We’re putting together a strategic investing plan to replace their incomes and guarantee they’ll be able to retire on the same income or more.

And we’d like to offer you an opportunity to do the same.

It starts with a short discovery call with one of our strategists.

They’ll talk to you about what you really want in the future.

And give you an idea of what your new options will be with a carefully planned real estate investing plan.

Click here to book a time with one of our strategists

There’s no cost for this.

It’s just to assess where you are and where you want to end up.

Click the link and get some answers.

To your future,

P.S. You might not be proud of where you are financially right now.

If not, don’t worry.

Most people find themselves in a spot they don’t want to be.

So you’re not alone.

Let’s get on a call together and work through a rescue plan for you.

Click here to book a discovery call and start to create your own personalised rescue plan

5 Oct 2022 - Gotta love interest rate rises, right?

![]()

Hi,

I’m a strange kind of person.

I hate long walks on the beach and romantic movies.

But I love interest rate rises.

(Actually, the walks on the beach and the movies are fine, really).

So why would a real estate investment advisor … LOVE rate rise?

It’s because these are the times you make the most money.

Hear me out.

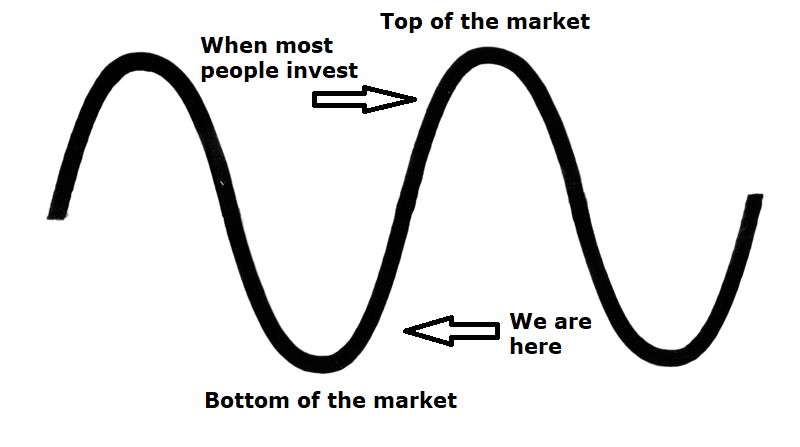

Here’s a really basic property market curve. (You might have to enable images to see it).

We’ve got the top and bottom of the markets.

And right now we’re at the bottom. I’ve drawn an arrow to show you where we are, and that’s probably just past the worst of it.

Most investors, by the way, invest near the top of the market.

They see prices booming and everyone getting rich, so FOMO hits and they pile in.

(FOMO is Fear Of Missing Out.)

Now, you might think that right now is a terrible time to invest.

Interest rates are still climbing.

Prices have been dropping and might continue dropping in some parts.

Does it make more sense to you to invest at the bottom of the market and enjoy all that capital growth and rental increases?

Or do you think it’s smartest to invest once the majority of the growth and rent increases have passed by?

This is why I love interest rate rises.

They’re a sign that the lowest point in the market is either here or at least very close.

And we’ve been in a rising interest rate environment for 6 months now.

The market’s going to turn upwards.

The signs are already there with auction clearance rates up to 66.8% last weekend, with a slow but steady increase every week from around 60% two months ago.

Immigration is returning, and Albo just added another 35,000 to the numbers.

And inflation is starting to ease off.

See why I love investing at the bottom?

All that up curve?

It’s mine!

Why not book a time with one of our strategists and see what’s possible for you too?

Click here to book a call with one of our strategists and see what your next move should be.

To your future prosperity,

[Insert PSs here]

29 Sept 2022 - Pay off your home loan in under 10 years, and other lies

Hi,

Have you heard?

Apparently, you can buy an investment property and pay off your home loan in 10 years or less.

Well, I’m calling BS.

There are ways it COULD be done.

But hey, don’t believe the hype that anyone can do it.

You’d have to have a pretty small loan for a start.

(The average mortgage today is just shy of $600k).

Then you’d need to be relying on interest rates NOT climbing more.

(They will).

(Good chance it will, but there’s not guarantees in this world).

Listen.

I don’t make projections like these.

I make projections that can be met.

So yep, we’re a little conservative at times.

But we’re also realistic.

And since nobody can afford to get 10 years down the track and discover things didn’t quite work as they expected …

… I’m going to suggest you run some of the wild claims you hear through your BS meter first.

BTW if you get an actual, realistic plan there’s a good chance you’ll be surprised at what’s possible with the right strategy behind you.

You can book a time with us below.

To your future prosperity,

[PSs go here]

19 Sept 2022 - Slick Willie’s secret to wealth

Hi,

Most people overlook the obvious when it comes to wealth creation.

They think they have to invest in high risk shares.

Or even Bitcoin.

Or score an inheritance or win the lottery.

To explain what I mean, let me tell you a story about Slick Willie.

Willie Sutton, also known as Slick Willie was one of America’s most famous bank robbers. His stellar career lasted almost 40 years.

According to the stories he is rumored to have stolen over $2 million dollars. And that’s a lot for someone who started in the 1920s!

Someone once asked Slick Willie why he robbed banks.

And his reply was priceless.

“Because that’s where the money is”.

Kind of obvious, right?

This is why I love real estate.

Everyone NEEDS a house to live in, so there’s always demand for what you’ve got.

We’ve got a chronic undersupply too.

And the government policies are designed to keep house prices going up.

Here’s where it gets really exciting.

Right now, amateur investors are scared.

They’re sitting on the sidelines believing the media BS that the market’s going to crash and investors will be heading for the poor house.

Except the exact opposite is true.

Right now is the perfect time to be in the market.

Prices are down and buyer activity is low.

This means instead of buying at the peak and competing in a frenzy …

… you’ll have the pick of the bunch.

And be able to ride it all the way from the bottom to the top.

With the right plan, 2022 could be the start of something amazing.

To your future success,

11 Sept 2022 - Rent freeze … madness?

Hi,

I meant to talk about this last week.

However, since Albo just sparked a brand new property boom by bumping our already immigration intake of 160,000 people (who we don’t have houses for) up by another 35,000 (who we DEFINITELY don’t have houses for) I wanted to tackle that instead.

And now I’m back to rent freezes.

Now, just to be clear.

Rent-freezes are not government policy.

They’re a proposal by the Greens who aren’t in power anyway, and it’s a policy even Labor isn’t stupid enough to take on.

So don’t stress, OK?

However, in case you think they’re a great idea, or you’ve got someone in your family who does then there’s a very good argument against them.

And the case against them is simply this.

You see, rents, interest rates, and inflation aren’t really the cause of the housing crisis.

The one cause above all else is …

.. we don’t have enough houses.

New housing supply is miles behind where it needs to be.

In fact, the Australian Financial Review recently reported we could be 163,400 dwellings short of where we need to be by 2032.

This means, even if we keep building more homes at the current rate, we’re still falling drastically behind.

Now, what would happen if we introduced rent freezes?

Well, some investors could be encouraged to sell.

And now all those renters would be homeless looking for another house along with thousands of other renters.

I can’t see this being helpful, can you?

And who would buy the houses they previously lived in?

Probably the people who are already in the market and missing out.

It won’t be struggling renters, that’s for sure.

Most of the people struggling to pay their rent don’t have big deposits saved up.

Nor would they likely have the kind of income needed to qualify for a loan right now.

So, that strikes one against rent freezes.

Is there a strike two?

Yes, there is.

When you limit returns, you get fewer developers building.

Investors are a big market for new housing, and there won’t be as many investors buying in.

Plus, if house prices drop as a result then fewer projects will be economically feasible and so fewer will actually go ahead.

Result?

Fewer new houses are being built at a time we desperately need them.

So you can see, there’s really no other option other than letting the market sort itself out.

Is it perfect?

No.

Is it without pain?

No.

However, it’s the only way.

Anyway, keep informed and keep thinking.

To your future prosperity,

{Normal PSs go here}

4 Sept 2022 - Albo accidentally creates a brand new property boom

Hi,

I was going to talk about the proposed rent hike this week, but something else came up suddenly.

And since it’s been in the news I wanted to talk about this instead.

(I’ll get back to the rent freeze madness next week, OK?)

You see, despite making a bit of song and dance about homelessness before the election, at the jobs summit last week Anthony Albanese announced …

… an additional 35,000 immigrants each year on top of the 160,000 already announced.

Ok, so we need more people to fill jobs.

The folks at my local fish and chip shop look like they’re about to collapse and they’ve had that ‘We’re Hiring’ sign on the door for 3 years now.

Still, could it backfire?

Let’s do a bit of maths.

Ready?

The average household size in Australia is 2.5 people.

And this means 35,000 extra people will need an extra 14,000 houses per year.

That’s on top of what we need for our growing population … and the 160,000 immigrants already lining up to come here.

Now, an extra 35,000 new immigrants at an average of 2.5 people per home = 14,000 extra homes per year.

But wait!

Albo’s going to be building more houses as social housing, right?

I mean, that’ll help ease the housing crisis, won’t it?

Um, no.